In these difficult times, you can get a head of the game when applying for any of the benefits by being registered with a CRA my account, be it personal or for business. It’s safe and secure and means that you will have immediate access to your tax information and benefits. Business owners (including partners, directors, and officers) can access their GST/HST, payroll, corporation income taxes, excise taxes, excise duties and other levies accounts online.

Once you have an account you can also change your direct deposit information which will shorten the time it takes CRA to get money into your bank account as there will be no delay for cheques being cut and mailed to you.

It’s so easy to sign up for “My Account” you’ll wonder why you haven’t done it in the past!

To register for My Account (Personal or Business) simply follow the steps below:

Businesses, you’ll have to complete two steps.

Step 1 – Provide personal information

- Enter your social insurance number.

- Enter your date of birth.

- Enter your current postal code.

- Enter an amount you entered on one of your income tax and benefit returns. Have a copy of your returns handy. (The line amount requested will vary. It could be from the current tax year or the previous one.) To register, a return for one of these two years must have been filed and assessed.

- Create a CRA user ID and password. Or use Sign-in Partner discussed below.

- Create your security questions and answers. You can also decide if you want a persistent cookie added to your computer, so that you can access CRA Login Services using that same computer later without being asked for more identification.

- Enter your business number.

Step 2 – Enter the CRA security code which will be sent to you by mail or you can call and ask for it to be sent by email.

To access your account, return to either My Account Individual or My Business Account, select “CRA login,” and enter your CRA user ID and password. When prompted, enter your CRA security code.

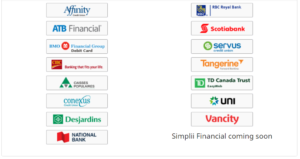

You can also log into CRA Login Services with a Sign-in Partner. This option lets you log in with a user ID and password that you may already have if you bank with any of the below institutions.

Due to high volumes of applications at the moment they are suggesting that you apply on certain days of the week according to your birth month.

Monday – Jan, Feb, March

Tuesday – Apr, May, June

Wednesday – July Aug, Sept

Thursday – Oct, Nov, Dec.

Friday, Saturday & Sunday – Any month.

The preceding information is for educational purposes only. As it is impossible to include all situations, circumstances and exceptions in a blog such as this, a further review should be done by a qualified professional.

No individual or organization involved in either the preparation or distribution of this letter accepts any contractual, tortious, or any other form of liability for its contents or for any consequences arising from its use.